French Fractional | Why and how can I transfer my share to my children?

This article is for French properties, other countries have other laws and you should consult with us first. Spain is very similar but can be very different in some regions.

Why and how can I transfer my share to relatives (or anyone else)?

A second home, often filled with memories, is a genuine family asset. That’s why many owners are eager to pass it on to their descendants, whether children or grandchildren. Moreover, the transfer of shares in a real estate company (French SCI property company) offers many tax benefits. You can also transfer your share(s) to anyone you want to but you will not benefit from the usual inheritance benefits linked to family transfers.

To whom can I transfer my share as a gift or inheritance? In most cases, in France, the donation of shares in an SCI is done in the first place to easily pass on an estate to heirs, children or grandchildren, but you can also transfer your shares to your spouse, siblings, or a third party. For legal formalities, we advise you to consult a French notary or ask to be connected with our partner notaries or lawyers.

What are the tax benefits in France? (inheritance tax…)

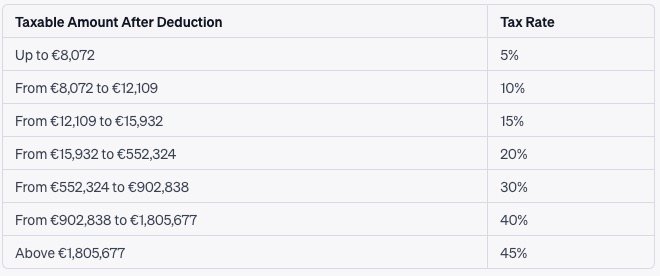

The taxation* is the same whether it’s a donation (inter vivos transfer) or an inheritance (transfer after death).

In terms of formalities, making a donation of shares in an attribution SCI is much less cumbersome than directly transferring a traditional ownership property.

Furthermore, you can gradually transfer your SCI shares, allowing your heirs to benefit from the tax deductions on inheritance rights. These deductions on inheritance rights apply differently based on the degree of kinship:

Donation from parents to children: exemption from paying inheritance tax up to €100,000 every 15 years.

Donation from grandparents to grandchildren: exemption from paying inheritance tax up to €31,865 every 15 years.

Donation from great-grandparents to great-grandchildren: exemption from paying inheritance tax up to €5,310 every 15 years.

For French clients who have taken out a French mortgage to finance the share: if a loan was taken out at the SCI level to finance the property (not the case for non-French tax residents), it reduces the value of the shares, and therefore the basis for calculating the donation or inheritance rights. They are indeed calculated on the net assets of the SCI, which is not the case when the donation of a property is made directly between the donor and the beneficiary.

What to do in case of death?

In the event of the death of a co-owner shareholder, the heir(s) must inform the property management company as soon as possible of their decision to keep or not the SCI company share(s), allowing the property manager to offer the shares to the other shareholders. Very often other shareholders will be interested in purchasing an extra share in their property for themselves or for family relatives or friends.

If the heirs want to keep the share(s), they will need to liaise with the property manager on how to become the shareholder of the company themselves. If the heirs do not wish to keep the share(s) and no other shareholder decides to purchase them, then the heir will be able to sell that share on the market at market value or through us for a typical agent commission (5%).

The dismemberment of the property share at purchase and how to plan ahead when you wish to donate to your children in advance

Is it possible to “dismember” my second home share? The principle of property dismemberment is to split the full ownership of a property into two parts:

- Bare Ownership (Nue-propriété): the right to dispose of the property.

- Usufruct (Usufruit): the right to use the property and receive its benefits.

For acquiring a second home share, dismemberment is possible, but it is mandatory for a representative to be designated between the bare owner and the usufruct holder. In the absence of this designation, the usufruct holder is deemed to assume this role alone concerning the SCI. By derogation from Article 1844 of the Civil Code, the usufruct holder then has the sole voting right, whether in an extraordinary general meeting or in an ordinary general meeting.

However, both the usufruct holder and the bare owner are invited to general meetings, can participate, and receive the same documents.