France Fractional Ownership Properties | Second Home Co-Ownership Across French Alps, Paris & Côte d'Azur

Discover France fractional ownership properties spanning the country’s most prestigious vacation destinations—French Alps ski chalets, Paris city apartments, and South of France Mediterranean villas—where deeded co-ownership delivers access to luxury European vacation homes without the full commitment of sole ownership. France co-ownership combines world-class skiing, cultural immersion, and coastal living in a single European property portfolio, with 6-7 weeks annual usage across multiple properties and seasons, managed professionally and shared among small ownership groups.

France represents Europe’s most diverse vacation home market, with international buyers accounting for nearly 2% of all French property transactions—rising to 13% in Mediterranean Alpes-Maritimes and 12% in alpine Haute-Savoie. French fractional ownership properties recorded exceptional performance in 2024-2025, with the French Riviera generating €9 billion in transactions (+12% annually), Parisian luxury segment surging +69% in Q1 2025, and French Alps ski properties maintaining strong demand driven by limited mountain supply. France vacation homes provide unmatched lifestyle diversity—Mediterranean beaches with 300+ days of sunshine, world-class Alpine skiing across the globe’s largest interconnected ski area, Parisian cultural immersion with world-renowned museums, and wine regions spanning Burgundy, Bordeaux, and Provence.

Explore France fractional ownership by region:

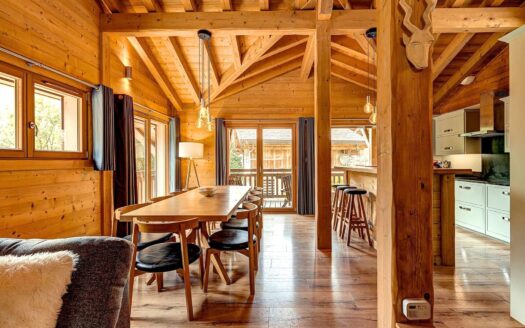

French Alps Fractional Ownership Properties – Ski-in/ski-out chalets in Méribel, Courchevel, Val d’Isère, Chamonix

South of France Fractional Ownership Properties – Côte d’Azur villas in Cannes, Nice, Saint-Tropez, Antibes, Provence

Paris Fractional Ownership Properties – Haussmannian apartments in 6th arrondissement Saint-Germain, 7th arrondissement Eiffel Tower district

Chamonix, French Alps | 2-Bed Maisonette Mont Blanc Private Sauna

Méribel, French Alps | 2-Bed Penthouse Les 3 Vallées Ski Access

Sainte-Maxime, France | 4-Bed Luxury Villa Bay Of Saint-Tropez

Paris, Le Marais 4th Arrondissement | 18th Century 2-Bed With Private Terrace

Vallauris, France | 3-Bed Penthouse Near Cannes

Antibes, France | 2-Bed Apartment Near Beach

Vallauris, France | 4-Bed Villa With Sea Views

Saint-Aygulf, France | 4-Bed Villa With Sea Views

Morzine, French Alps | 2-bed apartment close to all amenities

Morzine, French Alps | 6-bed chalet with views and jacuzzi

Paris, France | 2-Bed Apartment On Rue Madame

Mougins | 7-Bed Villa with Pool and Views of Esterel Mounts

Courchevel 1650 | Exclusive 4-Bed Apartment Next To Lifts

Courchevel 1650 | Exclusive 4-Bed Apartment With Spa Next To Lifts

Sainte-Maxime | New-Build Garden Apartment With Sea View & Heated Pool

Grimaud | Provence-Style House With Garden & Heated Pool

France Paris 7th | City Apartment With Amazing Eiffel Tower View

Tignes | Ski-In/Ski-Out 6-Bed Apartment With Extensive Terrace

Tignes | Ski-In/Ski-Out 5-Bed Apartment With Extensive Terrace With Hot Tub

Les Gets | New-Build 4-Bed Apartment With Spa Next To Lifts

Les Gets | New-Build 4-Bed Apartment With Balcony & Spa Access

Méribel 3 Valleys | 3-Bed Residence with private Spa

Méribel 3 Valleys | Luxury 6-Bed Duplex Residence With Terrace Hot Tub

Les Issambres | Côte d’Azur Modern Sea-View Villa with Heated Pool

Cannes | Semi-Detached Home with Sea & City Views

Cannes French Riviera | First‑Line Penthouse with Panoramic Roof Terrace

Beaune, Burgundy | Restored 17th-Century Château

Paris | Iconic Left bank Residence

Nice – Bellevue | Classic 3-Bed Residence with sea Views

Cannes – Villa Estérel | 5-Bed Villa With Pool

Chamonix | Mont Blanc Lodge

Meribel | Luxury 3-Bed Ski-In/Ski-Out Alpine Retreat

Paris 6th District | Saint-Germain Apartment

Paris 7th-District | 2 Bed 19th Century Parisian Residence

Why Choose France Fractional Ownership?

France fractional ownership delivers unmatched European lifestyle diversity within a single country—world-class skiing in the French Alps, Mediterranean beaches along the Côte d’Azur, Parisian cultural immersion, wine country estates in Bordeaux, Burgundy, and Champagne, plus countryside charm across Provence, Dordogne, and Normandy. France co-ownership properties allow you to build a complete European vacation portfolio without purchasing multiple sole-ownership properties, with professional management, predictable shared costs, and 6-7 weeks annual usage spread strategically across seasons and regions maximizing lifestyle value.

Unmatched Regional Diversity: Alps, Mediterranean, Paris & Wine Country

France is the only European country offering elite-tier experiences across four distinct vacation categories—alpine skiing, Mediterranean coastal living, global city culture, and wine tourism—all within domestic borders and high-speed rail connectivity. This geographic diversity makes France fractional ownership uniquely efficient for families seeking year-round European vacation options without managing properties across multiple countries, currencies, and legal systems.

French Alps fractional ownership provides winter skiing across the world’s largest interconnected ski area (Les Trois Vallées with 600+ kilometers), spring ski touring on glaciers, summer mountain biking and hiking, and autumn vineyard tours in alpine wine regions. Foreign buyers represent 12% of transactions in Haute-Savoie (Chamonix, Megève), demonstrating sustained international demand for French Alps real estate from British, Dutch, Belgian, Scandinavian, and North American buyers seeking European ski properties.

South of France fractional ownership delivers summer Mediterranean beach season, spring cultural events (Cannes Film Festival, Nice Carnival), autumn yacht regattas (Les Voiles de Saint-Tropez), and mild winters (10-15°C) with 300+ days annual sunshine—creating genuine four-season coastal appeal rare in European beach destinations. Foreign buyers account for 13% of property transactions in Alpes-Maritimes (Nice, Cannes, Antibes), with the French Riviera recording €9 billion in transactions in 2024 and average prices rising 8.7%.

Paris fractional ownership offers year-round city lifestyle—world-class museums (Louvre, Musée d’Orsay, Centre Pompidou), Michelin-starred dining, haute couture Fashion Week (March and September), Christmas markets, and cultural calendar spanning opera, theater, exhibitions, and festivals across all seasons. The Parisian luxury segment recorded +69% transaction growth in Q1 2025 versus 2024, with prime arrondissements (6th Saint-Germain, 7th Eiffel Tower) commanding €15,000-€30,000 per square meter.

French wine regions—Bordeaux, Burgundy, Champagne, Rhône Valley, Loire Valley—provide wine tourism, château tours, gastronomy experiences, and countryside tranquility complementing France’s coastal and mountain destinations. Burgundy fractional ownership near Beaune delivers 17th-century château living, vineyard access, and oenology immersion in France’s most prestigious Pinot Noir and Chardonnay region.

This diversity means France fractional owners can allocate their 6-7 annual weeks strategically: winter skiing in Méribel, spring culture in Paris, summer beaches in Cannes, autumn wine harvest in Burgundy—maximizing lifestyle value from European vacation home ownership without managing properties across multiple countries.

Strong Investment Performance Across Regions

France fractional ownership properties benefit from strong regional investment performance across luxury segments, with 2024-2025 data showing French Riviera, Paris, and French Alps markets outperforming national averages and demonstrating resilience despite broader European corrections.

The French real estate market is stabilizing in 2025 with +1% projected national price growth after 2024 adjustments, but luxury vacation home markets in prime French destinations significantly outperformed, creating attractive fractional ownership entry points as markets rebound. Foreign investment remains robust, with international buyers representing 2% of all French property transactions nationally—rising to 13% in Alpes-Maritimes (Côte d’Azur) and 12% in Haute-Savoie (French Alps)—demonstrating sustained cross-border demand for French vacation properties.

French Riviera luxury real estate performance:

The Côte d’Azur recorded over €9 billion in real estate transactions in 2024—a 12% increase versus 2023—with average property prices rising 8.7% across the region. Properties priced over €5 million accounted for 30% of total transactions, demonstrating exceptional ultra-high-net-worth demand for Mediterranean waterfront villas and beachfront penthouses. Saint-Tropez led appreciation with 15% price growth in 2024, pushing prime properties to €18,000/m² and achieving 48.36% cumulative growth since 2018 (nearly 10% annual compounded returns). Antibes surged 20.8% annually—one of Europe’s fastest-appreciating coastal markets—while Cannes recorded 12% growth with luxury properties averaging €10,000-€25,000/m².

Paris luxury real estate performance:

The Parisian luxury segment recorded +69% transaction growth in Q1 2025 compared to Q1 2024, signaling aggressive rebound and international buyer return to French capital properties. Paris 6th arrondissement (Saint-Germain-des-Prés) commands the city’s highest prices—averaging over €15,000/m² with prime apartments reaching €20,000-€30,000/m²—reflecting extreme scarcity and sustained demand for Left Bank prestige addresses. Paris 7th arrondissement apartments with Eiffel Tower views sold at €17,637/m², demonstrating premiums for iconic locations. American investors spend an average of €715,000 on Paris luxury purchases, while British, Scandinavian, and Benelux buyers remain active despite currency fluctuations.

French Alps ski property resilience:

French Alps vacation homes maintain strong demand driven by limited mountain real estate supply, protected alpine zones preventing overdevelopment, and sustained international buyer interest in premier ski resorts. Foreign buyers represent 12% of Haute-Savoie transactions, with British buyers (historically dominant) joined by increasing Dutch, Belgian, Scandinavian, and North American purchasers seeking European ski chalets. Méribel and Courchevel properties command premium pricing due to Les Trois Vallées access and luxury infrastructure, while Val d’Isère, Chamonix, and Paradiski resorts offer competitive entry points with strong rental yield potential.

Investment advantages unique to France fractional ownership:

Capital efficiency: Your €500,000 fractional share buys 1/8th ownership in a €4 million property—capturing identical percentage appreciation as sole ownership while freeing capital for diversified investments or additional fractional properties across French Alps, Paris, and Côte d’Azur.

Regional diversification: France fractional portfolios spread risk across three uncorrelated markets—alpine ski real estate, Mediterranean coastal property, global city apartments—reducing concentration risk versus single-location sole ownership.

International buyer liquidity: 2% national foreign buyer share (rising to 12-13% in premier destinations) creates deep buyer pools for resale, with American, British, Benelux, Scandinavian, and Middle Eastern demand supporting fractional share liquidity.

Rental income diversification: Year-round rental potential across regions—winter ski season in Alps, summer beach rentals in Côte d’Azur, spring and autumn city breaks in Paris—maximizes income from unused weeks versus single-season properties.

Currency and economic resilience: France’s Eurozone membership, AAA-rated government bonds, diversified economy, and global city status (Paris) provide institutional-grade stability rare in vacation property markets.

For fractional ownership buyers, deeded shares in French vacation properties appreciate proportionally with full property values—Saint-Tropez’s 15% annual growth, Antibes’ 20.8% surge, Paris luxury’s +69% transaction rebound, and French Alps’ resilient demand deliver identical percentage returns whether you own 1/8th or 100%, while fractional structure optimizes capital efficiency and usage alignment.

French Alps Fractional Ownership: World-Class Skiing & Four-Season Alpine Living

French Alps fractional ownership properties deliver world-class skiing, alpine village charm, and four-season mountain lifestyle across the world’s largest interconnected ski area and Europe’s most prestigious winter sports destination. French Alps co-ownership in Méribel, Courchevel, Val d’Isère, Chamonix, Les Arcs, La Plagne, Tignes, Morzine, and surrounding Tarentaise Valley resorts provides ski-in/ski-out access, luxury chalet amenities, and alpine living at a fraction of sole ownership costs in markets where mountain real estate commands premium pricing due to limited buildable land and protected alpine zones.

French Alps ski resorts rank among the world’s top winter destinations, with Les Trois Vallées (Méribel, Courchevel, Val Thorens) offering 600 kilometers of interconnected pistes—the largest ski area globally—and altitude range from 1,300m to 3,230m ensuring snow reliability throughout winter. Portes du Soleil (spanning France-Switzerland) provides 650 kilometers of skiing across 12 linked resorts, while Paradiski (Les Arcs-La Plagne) delivers 425 kilometers with diverse terrain and glacier access. Chamonix-Mont-Blanc attracts extreme skiing enthusiasts and mountaineering culture beneath Western Europe’s highest peak (4,808m), offering legendary off-piste terrain and Aiguille du Midi cable car (3,842m) with panoramic Alpine views.

French Alps vacation homes benefit from exceptional international accessibility—Geneva Airport (Switzerland) serves multiple French resorts within 60-120 minutes drive, Lyon Airport provides access to southern French Alps, and Chambéry and Grenoble regional airports offer seasonal ski connections. High-speed TGV rail connects Paris to Bourg-Saint-Maurice (gateway to Les Arcs, La Plagne, Les Trois Vallées) in 4-5 hours, making weekend ski trips feasible for European-based fractional owners. Eurostar Ski Train runs seasonally from London to French Alps (approximately 7 hours), providing car-free access for British fractional owners.

Foreign buyers represent 12% of property transactions in Haute-Savoie (Chamonix, Megève, Morzine), demonstrating sustained international demand for French Alps real estate. British buyers historically dominated (seeking European ski access post-Brexit), joined by increasing Dutch (10% of foreign buyers nationally), Belgian (7% of foreign buyers), Scandinavian, and North American purchasers attracted by world-class skiing, four-season activities, and alpine lifestyle.

French Alps fractional ownership chalets in Méribel and Courchevel offer ski-in/ski-out access, luxury amenities (outdoor hot tubs, saunas, wine cellars, cinema rooms), panoramic mountain views, and proximity to Michelin-starred alpine dining and luxury boutique shopping rivaling any European ski destination. French Alps ski season runs mid-December through April with glacier skiing at Val d’Isère, Tignes, and Les Deux Alpes extending into May-June, while summer alpine activities—mountain biking, hiking, paragliding, via ferrata, white-water rafting—create year-round property usage maximizing fractional ownership value.

Alpine lifestyle advantages include authentic French mountain villages with weekly markets, traditional Savoyard cuisine (fondue, raclette, tartiflette), thermal spas, and family-friendly culture prioritizing outdoor activities and quality of life over mass tourism. French Alps fractional owners enjoy both luxury resort infrastructure (ski schools, equipment rentals, childcare, fine dining) and authentic alpine charm (chalet architecture, local festivals, farmer cooperatives) creating balanced vacation experiences.

Explore French Alps Fractional Ownership Properties for complete details on ski resort locations, chalet amenities, investment performance, rental potential, and four-season alpine lifestyle.

South of France Fractional Ownership: Mediterranean Beaches, Côte d’Azur Glamour & Provençal Charm

South of France fractional ownership properties deliver Mediterranean beach access, Côte d’Azur glamour, and Provençal countryside charm across France’s most prestigious coastal destination—where 300+ days of annual sunshine, azure sea, world-class culture, and exceptional investment performance create year-round vacation appeal. South of France co-ownership in Cannes, Nice, Saint-Tropez, Antibes, Sainte-Maxime, Grimaud, Les Issambres, Vallauris, Mougins, and Provençal villages provides beachfront penthouses, sea-view villas, heated pool properties, hilltop village homes, and Burgundy wine châteaux in markets recording exceptional appreciation and ultra-luxury transaction growth.

The French Riviera recorded over €9 billion in real estate transactions in 2024—a 12% increase compared to 2023—with average Côte d’Azur property prices rising 8.7% significantly outperforming French national averages. Properties priced over €5 million accounted for 30% of total sales, demonstrating exceptional depth in ultra-high-net-worth demand for waterfront villas, beachfront penthouses, and sea-view estates along the Mediterranean coast.

Saint-Tropez led regional appreciation with 15% price growth in 2024, pushing prime property prices to €18,000 per square meter and achieving 48.36% cumulative growth since 2018—nearly 10% annual compounded returns over six years. Antibes showed explosive 20.8% annual appreciation, positioning it as one of Europe’s fastest-appreciating luxury coastal markets for buyers seeking Mediterranean yacht culture and competitive entry points compared to Saint-Tropez or Cap Ferrat ultra-premium pricing. Cannes recorded 12% price growth in 2024, with luxury properties averaging €10,000-€25,000/m² and ultra-prime Croisette beachfront penthouses exceeding €30,000/m².

South of France vacation homes attract international buyers at exceptional rates—foreign buyers represent 13% of all property transactions in Alpes-Maritimes (Nice, Cannes, Antibes, Saint-Tropez area), with Americans averaging €715,000 per purchase, demonstrating sustained North American demand for Côte d’Azur luxury real estate. British, Scandinavian, Benelux, Middle Eastern, and Asian buyers drive additional demand, creating deep international liquidity even in multi-million euro price segments.

Côte d’Azur fractional ownership provides deeded equity in multi-million euro beachfront villas and sea-view penthouses at accessible fractional share prices, capturing identical percentage appreciation as sole ownership while requiring substantially less capital—your €500,000 fractional share typically represents 1/8th ownership in a €4 million Mediterranean property.

South of France lifestyle combines legendary beaches (Plage du Midi Cannes, Promenade des Anglais Nice, Pampelonne Beach Saint-Tropez), cultural prestige (Cannes Film Festival, Monaco Grand Prix, Nice Carnival), Michelin-starred dining, luxury yacht culture (Port Vauban Antibes, Vieux Port Cannes, Saint-Tropez marina), and Provençal authenticity (hilltop villages, lavender fields, farmers’ markets, wine estates).

Year-round Mediterranean climate (300+ days of sunshine, mild winters 10-15°C, summer beach season, spring and autumn ideal weather) creates genuine four-season appeal rare in European coastal destinations, supporting both personal usage diversity and rental income potential across all seasons. Cultural calendar spans Cannes Film Festival (May), Jazz à Juan (July), Les Voiles de Saint-Tropez sailing regatta (September), Nice Carnival (February), and countless local festivals celebrating Provençal heritage, gastronomy, and Mediterranean lifestyle.

South of France fractional properties range from Cannes Croisette beachfront penthouses with panoramic sea views, to Saint-Tropez area villas with heated pools and yacht harbor proximity, to Provençal countryside homes in Vallauris and Mougins offering hilltop village charm minutes from Côte d’Azur beaches, to Burgundy wine châteaux near Beaune delivering 17th-century architecture and vineyard immersion.

Explore South of France Fractional Ownership Properties for complete details on Côte d’Azur locations, beach access, investment performance (15-20% annual appreciation in prime markets), cultural events, and Mediterranean lifestyle.

Paris Fractional Ownership: Cultural Immersion, Historic Architecture & Global City Living

Paris fractional ownership properties deliver European capital living, world-class cultural institutions, and Haussmannian architectural elegance in the 6th arrondissement (Saint-Germain-des-Prés) and 7th arrondissement (Eiffel Tower district)—Paris’s most prestigious Left Bank addresses. Paris co-ownership apartments provide pied-à-terre access to world-renowned museums (Louvre, Musée d’Orsay, Centre Pompidou), Michelin-starred dining, haute couture Fashion Week, and year-round cultural calendar in markets recording exceptional luxury segment recovery.

The Parisian luxury real estate segment recorded +69% transaction growth in Q1 2025 compared to Q1 2024, signaling aggressive rebound and international ultra-high-net-worth buyer return to French capital properties after pandemic-era withdrawals. Paris 6th arrondissement commands the city’s highest prices—averaging over €15,000 per square meter with prime Saint-Germain apartments reaching €20,000-€30,000/m² and exceptional properties (period features, elevator, outdoor space) exceeding these benchmarks. Paris 7th arrondissement apartments with Eiffel Tower views sold at €17,637/m², demonstrating premiums commanded by iconic vistas and embassy neighborhood prestige.

Paris fractional ownership appeals to cultural enthusiasts, international professionals, and families seeking European capital access without multi-million euro sole ownership commitments. American investors spend an average of €715,000 on Paris luxury purchases (sole ownership), while British, Scandinavian, Benelux, and Middle Eastern buyers remain active despite currency fluctuations, demonstrating that Paris pied-à-terre properties typically require substantial capital. Paris fractional shares (typically €400,000-€750,000 for 1/8th ownership) provide deeded equity in €3-6 million Haussmannian apartments, capturing identical percentage appreciation while optimizing capital efficiency and usage alignment (6-7 weeks annually).

Paris cultural institutions include the world’s most-visited museum (Louvre with 10 million annual visitors), finest Impressionist collection (Musée d’Orsay), Europe’s largest modern art museum (Centre Pompidou), plus Rodin, Picasso, Orangerie, Jacquemart-André, and dozens more creating unmatched museum density for Paris vacation home owners. Year-round cultural calendar spans Fashion Week (March and September), Paris Marathon (April), Bastille Day (July 14), Nuit Blanche arts festival (October), Christmas markets (December), and countless opera, theater, exhibition, and festival events.

Paris 6th arrondissement (Saint-Germain-des-Prés) offers literary heritage (Sartre, Hemingway, Picasso frequented legendary cafés), Luxembourg Gardens (Paris’s most beloved park), antique dealers, art galleries, independent bookshops, and gourmet food shops defining Left Bank prestige. Paris 7th arrondissement delivers Eiffel Tower proximity, embassy neighborhood elegance, Musée Rodin, Les Invalides (Napoleon’s tomb), and Rue Cler pedestrian market street with fromageries, boulangeries, and neighborhood bistros.

Paris lifestyle advantages include walkable neighborhoods, comprehensive Metro transit eliminating car ownership needs, Michelin-starred dining (Paris has more Michelin stars than any city except Tokyo), haute couture shopping (Chanel, Dior, Hermès flagship stores), and café culture allowing outdoor terrace sitting for people-watching and espresso across seasons.

Paris accessibility is unmatched—Charles de Gaulle Airport (Europe’s second-busiest, 300+ destinations), Eurostar to London (2h15), Brussels (1h30), Amsterdam (3h20), TGV high-speed rail to Lyon (2h), Marseille (3h15), Geneva (3h), Frankfurt (4h), plus direct intercontinental flights from New York (7h), Los Angeles (11h), Dubai (7h), Singapore (13h) make Paris fractional ownership accessible for global owners.

Explore Paris Fractional Ownership Properties for complete details on Left Bank arrondissements, Haussmannian architecture, cultural institutions, investment performance (+69% luxury transaction growth), and year-round city living.

Year-Round Lifestyle Diversity Across French Regions

France fractional ownership uniquely enables year-round European vacation optimization by allowing owners to allocate their 6-7 annual usage weeks strategically across complementary regions and seasonal experiences within a single country. This geographic and seasonal diversification maximizes lifestyle value compared to single-location vacation homes limited to one climate and activity profile.

Winter (December-March): Allocate weeks to French Alps fractional properties for ski season in Méribel, Courchevel, Val d’Isère, or Chamonix, enjoying 600+ kilometers of interconnected pistes, luxury chalet living, après-ski culture, and Savoyard cuisine. Paris fractional apartments offer winter city breaks with Christmas markets, museum season (fewer tourists), opera performances, Fashion Week (January/February), and cozy café culture.

Spring (April-June): Shift to Paris fractional ownership for spring cultural season—cherry blossoms in parks, Paris Marathon (April), mild weather (15-20°C) ideal for Seine cruises, museum visits without summer crowds, and outdoor café sitting. South of France properties shine in May-June with Cannes Film Festival, warm beach weather, lavender field blooms (late June), and spring festivals across Provençal villages.

Summer (July-August): Concentrate weeks in South of France fractional properties for peak Mediterranean beach season—sandy beaches, beach clubs, yacht culture, waterfront dining, Jazz à Juan festival (Antibes, July), Cannes Pyrotechnic Festival (July), and 300+ days of sunshine creating quintessential Côte d’Azur lifestyle. French Alps summer activities—mountain biking, hiking, paragliding, via ferrata—provide alpine alternatives to coastal heat.

Autumn (September-November): Return to South of France for autumn Mediterranean perfection—balmy weather (18-24°C), Les Voiles de Saint-Tropez sailing regatta (September), grape harvest across Provençal vineyards, and reduced crowds post-summer while beaches remain accessible. Paris Fashion Week (September) attracts global fashion industry, while autumn foliage in Tuileries Gardens and along tree-lined boulevards creates photogenic Parisian scenery. Burgundy fractional château near Beaune allows wine harvest participation and vineyard tours during oenology tourism peak season.

This strategic seasonal allocation means France fractional ownership portfolios deliver 12 months of vacation value rather than single-season utility—your combined French Alps + Paris + South of France properties provide ski holidays, city culture, beach vacations, and wine tourism all within domestic French borders, unified currency (Euro), and cohesive legal frameworks.

Investment Advantages: Capital Efficiency, Appreciation & Liquidity

France fractional ownership delivers investment-grade returns while optimizing capital efficiency, usage alignment, and portfolio diversification compared to sole ownership or international vacation property alternatives. Understanding fractional investment advantages helps buyers evaluate France co-ownership against traditional real estate and alternative vacation solutions.

Capital efficiency and proportional appreciation:

Your France fractional share appreciates proportionally with full property values, meaning you capture identical percentage returns whether owning 1/8th or 100%. Recent performance demonstrates this principle: Saint-Tropez properties gained 15% in 2024, so a Saint-Tropez fractional owner with a €300,000 share earned €45,000 equity gain (15%) just as a sole owner of a €2.4 million villa gained €360,000 (also 15%)—both are identical percentage returns on capital deployed.

Similarly, Paris luxury segment +69% transaction growth benefits fractional and sole owners equally—increased buyer demand drives price appreciation regardless of ownership structure. Antibes’ 20.8% annual appreciation and Cannes’ 12% growth deliver fractional owners the same percentage returns as sole owners, while freeing capital for diversified investments.

Instead of locking €4 million in a single Cannes penthouse used 4-6 weeks annually, fractional buyers deploy €500,000 for comparable usage and identical appreciation percentage, freeing €3.5 million for additional fractional properties (French Alps chalet + Paris apartment), traditional asset classes (stocks, bonds), or other investments—creating diversified portfolios reducing concentration risk.

Regional diversification within France:

France fractional portfolios spread investment across three uncorrelated markets—alpine ski real estate, Mediterranean coastal property, global city apartments—reducing risk versus single-location concentration. If Côte d’Azur tourism declines (climate change, economic recession), your Paris cultural property and French Alps ski chalet provide portfolio balance; if ski seasons shorten due to warming, Mediterranean and city properties maintain value.

International buyer liquidity:

France attracts sustained international demand—2% of all transactions nationally from foreign buyers, rising to 13% in Alpes-Maritimes (Côte d’Azur) and 12% in Haute-Savoie (French Alps). American, British (despite Brexit), Dutch (10% of foreign buyers), Belgian (7%), Scandinavian, and Middle Eastern buyers create deep resale liquidity for France fractional shares.

Fractional shares trade more easily than full luxury properties due to lower price points attracting larger buyer pools—selling a €500,000 Cannes fractional share requires finding one qualified buyer among thousands globally; selling a €4 million sole-ownership penthouse requires finding one ultra-high-net-worth buyer in a much smaller market.

Usage optimization eliminates “sole ownership penalty”:

Sole owners of French vacation properties typically use them 3-6 weeks annually (limited by work, school, competing vacation interests), meaning properties sit vacant 46-49 weeks while owners pay full annual costs (property taxes, utilities, insurance, maintenance) for 52 weeks. Fractional ownership eliminates this inefficiency—you pay only for weeks you’ll actually use plus proportional costs, while other co-owners utilize the property during weeks you’d leave it vacant anyway.

Professional management and operational simplicity:

France fractional ownership includes professional property management handling maintenance, contractor coordination, emergency repairs, seasonal preparations, cleaning between stays, and regulatory compliance, with costs split among 8 co-owners. This per-owner expense is typically lower than hiring private property managers for sole ownership, while eliminating time burden and language barriers for international owners based abroad.

Rental income diversification:

Year-round rental potential across France regions—winter ski season in French Alps, summer beach rentals in Côte d’Azur, spring/autumn city breaks in Paris—maximizes income from unused weeks versus single-season properties with limited rental windows. French tourism (90+ million annual visitors, world’s most-visited country) generates consistent demand supporting rental yields across regions and seasons.

Strong International Buyer Demand & Foreign Investment Trends

France attracts robust international buyer activity across luxury vacation home markets, with foreign purchasers representing nearly 2% of all French property transactions nationally—translating to tens of thousands of annual cross-border purchases demonstrating sustained global demand for French real estate. Regional concentration reaches 13% in Alpes-Maritimes (Côte d’Azur Mediterranean coast) and 12% in Haute-Savoie (French Alps ski resorts), positioning these France fractional ownership destinations among Europe’s most liquid international property markets.

International buyer motivations for France property ownership include:

Lifestyle diversity: Alpine skiing, Mediterranean beaches, cultural cities, wine regions, countryside charm—all within one country

Eurozone stability: Strong currency (Euro), AAA-rated bonds, institutional frameworks, property rights protection

Accessibility: Extensive international airports (Paris CDG, Nice, Lyon, Geneva for Alps), high-speed rail, Eurostar connections

Cultural prestige: World-renowned cuisine, fashion capital, wine heritage, architectural preservation, UNESCO sites

Rental income potential: 90+ million annual tourists, year-round appeal, diverse regional seasons supporting vacation rental demand

Appreciation potential: Luxury segments recording strong performance—French Riviera +8.7% average, Paris luxury +69% transactions, prime markets (Saint-Tropez +15%, Antibes +20.8%) significantly outperforming

For France fractional ownership buyers, this deep international demand creates liquidity for resale, competitive market dynamics supporting price appreciation, and validation that French vacation properties command global buyer interest across economic cycles.

Easy Access: International Airports, High-Speed Rail & European Connectivity

France fractional ownership properties benefit from Europe’s most developed transportation infrastructure, with international airports, high-speed TGV rail, Eurostar connections, and comprehensive domestic networks providing seamless access from global gateways and European cities.

Paris Charles de Gaulle Airport (CDG) ranks as Europe’s second-busiest airport with direct flights to 300+ global destinations, serving as primary gateway for Paris fractional ownership and offering intercontinental connections from North America (New York 7h, Los Angeles 11h, Toronto 8h), Middle East (Dubai 7h, Doha 6h30), Asia (Singapore 13h, Beijing 11h), plus comprehensive European network. Orly Airport (ORY) provides secondary Paris access with European and Mediterranean destinations, 30 minutes to Left Bank arrondissements.

Nice Côte d’Azur Airport (NCE)—France’s third-busiest—serves South of France fractional properties with 100+ destinations, positioned 20 minutes from Nice, 30 minutes to Antibes, 45 minutes to Cannes, providing direct access to Côte d’Azur vacation homes. Marseille Provence Airport (MRS) offers western Côte d’Azur access (90 minutes to Saint-Tropez area), while Toulon-Hyères Airport (TLN) provides regional service 45 minutes from Saint-Tropez, Grimaud, Sainte-Maxime.

Geneva Airport (GVA)—though in Switzerland—serves as primary gateway for French Alps fractional ownership, positioned 60-120 minutes from Chamonix, Morzine, Megève, and other Haute-Savoie resorts, with excellent international connectivity and seasonal ski transfers. Lyon Airport (LYS) provides access to southern French Alps and Rhône Valley, while Chambéry and Grenoble regional airports offer seasonal ski connections.

High-speed TGV rail network connects France fractional ownership regions efficiently:

Paris to French Alps: Bourg-Saint-Maurice (gateway to Les Arcs, La Plagne, Les Trois Vallées) in 4-5 hours, making weekend ski trips feasible for Paris-based owners

Paris to Côte d’Azur: Nice (5h30), Cannes (5h45), Antibes (5h30) direct TGV service

Paris to Burgundy: Beaune (2h30), Dijon (1h40) for wine region fractional properties

European capitals to France: London-Paris Eurostar (2h15), Brussels-Paris (1h30), Amsterdam-Paris (3h20), Geneva-Paris (3h), Frankfurt-Paris (4h)

Eurostar provides car-free access from UK to France, with London-Paris (2h15) and seasonal Eurostar Ski Train running London-French Alps (approximately 7 hours) offering direct service to Bourg-Saint-Maurice for British fractional owners. Domestic connectivity includes comprehensive Metro/RER in Paris eliminating car needs, regional rail serving Côte d’Azur coastal towns, and shuttle services connecting airports to ski resorts.

This transportation infrastructure makes France fractional ownership practical for global buyers—Americans can reach Paris apartments in 7-8 hours direct, Europeans access all France regions via short flights or high-speed rail, and inter-region travel within France allows owners to visit multiple fractional properties in single trips (e.g., Paris weekend + Côte d’Azur beach week).

What is fractional ownership in France?

Fractional ownership in France means co-owning a French vacation property with a small group of buyers (typically 8 co-owners), where each owner holds a deeded share (usually 1/8th) representing both equity and usage rights. This structure differs fundamentally from timeshares: with France fractional ownership, you own real property recorded in French land registry (cadastre), giving you the right to sell, mortgage, or pass the property to heirs, just like any French real estate asset.

Your 1/8th fractional share typically provides 6-7 weeks of annual usage spread across all seasons, managed through a fair rotation system that ensures every owner eventually accesses prime periods like French Alps ski season (December-March), Côte d’Azur summer beaches (July-August), Paris spring culture (April-June), and autumn wine harvest in Burgundy. A professional management company handles all property maintenance, cleaning between owner stays, scheduling coordination, and common area upkeep, with costs split proportionally among co-owners.

France co-ownership properties span three premier lifestyle destinations—French Alps ski chalets in Méribel, Courchevel, Val d’Isère, Chamonix; South of France Mediterranean villas in Cannes, Nice, Saint-Tropez, Antibes, Provence; and Paris Haussmannian apartments in 6th arrondissement Saint-Germain and 7th arrondissement Eiffel Tower district.

For families seeking European vacation diversity without multiple sole-ownership commitments, France fractional ownership provides deeded equity, predictable annual usage, and access to world-class skiing, Mediterranean beaches, and cultural capitals at a fraction of the capital required for full ownership.

Is France fractional ownership a good investment?

France fractional ownership combines lifestyle enjoyment with investment-grade real estate across Europe’s most diverse vacation market, with recent performance demonstrating strong regional appreciation and international buyer demand.

French Riviera recorded over €9 billion in transactions in 2024 (+12% annually), with average Côte d’Azur prices rising 8.7% and properties over €5 million accounting for 30% of sales. Saint-Tropez led with 15% appreciation in 2024 and 48.36% cumulative growth since 2018 (nearly 10% annual compounded returns), Antibes surged 20.8%, and Cannes gained 12%. Parisian luxury segment recorded +69% transaction growth in Q1 2025, with prime arrondissements commanding €15,000-€30,000/m². French Alps maintain resilient demand driven by limited mountain supply and 12% foreign buyer share in Haute-Savoie.

Investment advantages unique to France fractional ownership:

Capital efficiency: Your €500,000 fractional share captures identical percentage appreciation as €4 million sole ownership, while freeing €3.5 million for diversified investments

Regional diversification: Spread investment across alpine, Mediterranean, and city markets reducing single-location risk

International liquidity: Foreign buyers represent 2% of French transactions (13% in Côte d’Azur, 12% in French Alps), creating deep resale pools

Year-round rental income: Winter Alps skiing, summer Côte d’Azur beaches, spring/autumn Paris culture maximize rental potential across seasons

Eurozone stability: Strong currency, AAA-rated bonds, institutional frameworks, property rights protection

For fractional ownership buyers, deeded shares appreciate proportionally with full property values—Saint-Tropez’s 15%, Antibes’ 20.8%, Paris luxury’s +69% transactions deliver identical percentage returns whether owning 1/8th or 100%, while fractional structure optimizes capital deployment and usage alignment.

Why choose France over other European vacation destinations?

France offers unmatched lifestyle diversity within a single country—world-class Alpine skiing (600km+ interconnected pistes), Mediterranean beaches (300+ days sunshine), global city culture (Paris museums, Michelin dining), and wine regions (Bordeaux, Burgundy, Champagne)—eliminating the need for multi-country property portfolios.

France ranks as the world’s most-visited country with 90+ million annual tourists, demonstrating sustained global appeal supporting rental income and property values. International buyers represent 2% of all transactions (13% Côte d’Azur, 12% French Alps), with Americans averaging €715,000 purchases, British dominating Alpine markets, and Dutch accounting for 10% of foreign buyers—validating cross-border investment demand.

France cultural depth—45 UNESCO World Heritage sites (4th globally), world-leading Michelin stars, fashion capital (Paris), architectural preservation, wine heritage—creates authentic experiences unavailable in newer vacation markets. Transportation infrastructure (high-speed TGV, Eurostar, extensive airports) provides seamless access from European capitals and global gateways.

Compare to alternatives: Swiss Alps offer skiing but higher costs and limited beach access; Italian Riviera provides Mediterranean coast but less skiing infrastructure; Spanish costas deliver beaches but lack alpine options; France uniquely combines all lifestyle categories at institutional-grade investment levels.

What is the difference between France fractional ownership and timeshare?

France fractional ownership differs fundamentally from timeshares in ownership structure, property quality, investment value, and legal rights, making the distinction critical for buyers considering French vacation properties.

Ownership structure: With France fractional ownership, you own real property—actual deeded ownership recorded in French land registry (cadastre) that functions identically to buying any French real estate. Your 1/8th share in a Cannes beachfront penthouse, Méribel ski chalet, or Paris Haussmannian apartment represents tangible real estate equity you can sell on the open market, mortgage with lenders familiar with fractional properties, or pass to heirs through standard French succession law. Timeshares, by contrast, sell only the right to use a property for specific weeks—you own nothing tangible, no equity, and no transferable real estate asset.

Investment value: France fractional ownership properties appreciate over time alongside the full property value—recent data shows Saint-Tropez gaining 15% in 2024, Antibes surging 20.8%, Cannes recording 12%, and Paris luxury segment +69% transaction growth, meaning fractional owners captured identical percentage appreciation on their shares. When you sell your France co-ownership share, you capture market appreciation just like any French real estate investor. Timeshares rarely hold market value—most sell for pennies on the dollar if transferable at all, as you’re selling usage rights in properties you don’t own.

Co-owner relationships: France fractional ownership typically involves 8 co-owners sharing a luxury French property, creating a small, identifiable group with shared maintenance responsibilities and property care incentives. Timeshares may have 52 different week-holders with no relationship to one another, leading to inconsistent property care and high turnover degrading property quality.

Property quality: France fractional ownership focuses on luxury properties in premier locations—French Alps ski-in/ski-out chalets in Méribel and Courchevel, Côte d’Azur beachfront villas in Cannes and Saint-Tropez, Paris Haussmannian apartments in 6th and 7th arrondissements. Timeshares often involve dated resort complexes with hundreds of units, lacking the authentic French architecture and boutique character that defines luxury French vacation homes.

Bottom line for buyers: If you’re seeking investment-grade France real estate with genuine equity, appreciation potential matching regional performance (8.7% Côte d’Azur average, 15-20% in prime locations, +69% Paris transactions), and the ability to pass your French vacation home to children, choose fractional ownership. For discerning buyers building European property portfolios, France fractional ownership delivers true real estate ownership in Europe’s most diverse vacation destination.

Is France fractional ownership a good investment compared to sole ownership?

France fractional ownership provides comparable investment returns to sole ownership while requiring significantly less capital and delivering better capital efficiency for buyers building diversified vacation property portfolios. Understanding the financial comparison helps investors evaluate whether co-ownership or sole ownership better serves their French real estate investment goals.

Appreciation potential—identical percentage gains: Your France fractional share appreciates proportionally with the full property value, meaning you capture identical percentage returns whether owning 1/8th or 100%. Recent market data demonstrates this principle: Saint-Tropez properties appreciated 15% in 2024, so a fractional owner with a €300,000 share gained €45,000 in equity (15%) just as a sole owner of a €2.4 million villa gained €360,000 (also 15%)—both are identical percentage returns on capital deployed. Similarly, Paris luxury segment +69% transaction growth and Antibes’ 20.8% surge benefit fractional and sole owners equally on a percentage basis.

Capital efficiency and portfolio diversification: Instead of locking €4 million in a single Cannes penthouse used 4-6 weeks annually, fractional buyers deploy €500,000 for comparable usage and identical appreciation percentage, freeing €3.5 million for additional fractional properties (French Alps chalet + Paris apartment), traditional investments (stocks, bonds, REITs), or other asset classes—creating diversified portfolios reducing concentration risk. This portfolio approach means a €1.5 million investment can buy 1/8th shares in three France fractional properties (Alps + Paris + Côte d’Azur), delivering year-round lifestyle diversity versus single-location sole ownership.

Usage optimization—the “sole ownership penalty”: Sole owners of French vacation properties typically use them 3-6 weeks annually (limited by work schedules, school calendars, competing vacation interests), meaning properties sit vacant 46-49 weeks while owners pay full annual costs for 52 weeks. Fractional ownership eliminates this inefficiency—you pay only for weeks you’ll actually use plus proportional costs, while other co-owners utilize the property during weeks you’d leave it vacant anyway. The financial logic strongly favors fractional ownership for buyers honest about actual usage patterns.

Professional management value: Sole ownership requires owners to coordinate all property maintenance, contractor services, emergency repairs, seasonal preparations, regulatory compliance, and language barriers (for international owners)—time-consuming and difficult from abroad. France fractional ownership includes professional management handling all operational tasks, with costs split among 8 co-owners, making per-owner management expenses lower than hiring private property managers for sole ownership. This convenience particularly benefits international buyers based in North America, UK, Scandinavia, or outside Europe.

Liquidity and exit strategies: Fractional shares in desirable France locations (especially Cannes beachfront, Saint-Tropez villas, Méribel ski chalets, Paris Left Bank apartments) trade more easily than full luxury properties due to lower price points attracting more buyers. Selling a €500,000 France co-ownership share requires finding one qualified buyer; selling a €4 million sole-ownership property requires finding one ultra-high-net-worth buyer—a much smaller market. With international buyers representing 2% of French transactions (13% Côte d’Azur, 12% French Alps), fractional shares benefit from deep cross-border buyer pools.

Tax and carrying cost advantages: Fractional ownership proportionally reduces annual property taxes (French taxe foncière), building charges, insurance premiums, and utility costs compared to sole ownership—you pay 1/8th of these expenses rather than 100%. For buyers seeking France lifestyle access without maximum capital commitment and carrying costs, fractional ownership optimizes the cost-benefit equation.

Bottom line for investors: Choose France sole ownership if you’ll personally use the property 12+ weeks annually, want complete control over every property decision, or prioritize absolute privacy over economic efficiency. Choose France fractional ownership if you’ll realistically use 6-7 weeks annually, value capital efficiency and portfolio diversification, appreciate professional management, and recognize that identical appreciation percentage on €500,000 is financially smarter than identical percentage on €4 million when actual usage is comparable. For most buyers building European vacation property portfolios, fractional ownership delivers superior risk-adjusted returns and lifestyle flexibility.

Can I use my France fractional ownership weeks in different properties?

Most France fractional ownership structures provide usage rights specific to your owned property, meaning your 6-7 weeks apply to that particular French Alps chalet, Côte d’Azur villa, or Paris apartment where you hold deeded shares. However, buyers seeking multi-property access can purchase fractional shares in multiple France properties across different regions, creating a personal vacation portfolio with usage rights in Alps, Paris, and South of France.

Building a France fractional portfolio: Rather than buying sole ownership of one €4 million French property, many buyers deploy €1.5-2 million across three fractional shares in complementary locations—for example, a Méribel ski chalet (€500,000 share for winter skiing), a Cannes beachfront penthouse (€500,000 share for summer Mediterranean), and a Paris Left Bank apartment (€500,000 share for spring/autumn culture). This portfolio approach delivers year-round vacation diversity across France’s lifestyle destinations while maintaining deeded equity in each property.

Regional allocation strategies: France fractional owners with multiple properties can strategically allocate their combined usage weeks across seasons—December-March in French Alps ski properties, April-June in Paris cultural apartments, July-September in South of France beach villas, October-November back to Paris or Burgundy wine regions—maximizing lifestyle value from European vacation home ownership.

Exchange programs: Some fractional ownership management companies offer exchange networks allowing owners to swap unused weeks in their property for stays at other fractional properties globally, though this varies by operator and agreement structure. Prospective buyers should inquire about exchange options if multi-property access beyond owned shares is a priority.

Bottom line: France fractional ownership provides fixed usage rights in owned properties, but buyers can create personal vacation portfolios by purchasing multiple fractional shares across French Alps, Paris, and South of France, delivering year-round lifestyle diversity and regional investment diversification.

Do I own real property with France fractional ownership?

Yes, France fractional ownership provides genuine real property ownership—your 1/8th share is deeded ownership recorded in French land registry (cadastre) with identical legal status to any French real estate purchase. This fundamental distinction separates fractional ownership from timeshares, vacation clubs, or rental arrangements that provide only usage rights without property equity.

Legal structure: France fractional ownership typically structures as copropriété (French condominium ownership) or SCI (Société Civile Immobilière—civil real estate company), both providing deeded shares representing tangible property interest. Your name appears on official property documents filed with French authorities, establishing legal ownership protected under French property law.

Ownership rights: As deeded owner of a France fractional share, you have the right to:

Sell your share on the open market to qualified buyers, capturing market appreciation

Mortgage your share with lenders familiar with fractional ownership structures

Pass ownership to heirs through standard French succession law and estate planning

Participate in co-owner decisions regarding property management, capital improvements, and policies

Use the property for your allocated weeks each year according to rotation agreements

Appreciation and equity: Because you own real property, your France fractional share appreciates (or depreciates) proportionally with the full property value—recent data shows Saint-Tropez +15%, Antibes +20.8%, Cannes +12%, Paris luxury +69% transactions, meaning fractional owners captured these gains just like sole owners. When you sell, you receive market value for your share reflecting current property values.

Comparison to timeshares: Timeshares sell only usage rights—you own nothing tangible, cannot sell for market value (most timeshares sell for pennies if transferable), and have no equity appreciation. France fractional ownership is genuine real estate investment with deeded property, market liquidity, and appreciation potential matching full ownership percentage returns.

Can I pass my France fractional ownership to my children?

Yes, France fractional ownership is transferable to heirs through standard French succession law and estate planning, allowing you to pass your European vacation home to children or other beneficiaries just like any French real estate asset. This generational wealth transfer capability distinguishes fractional ownership from timeshares or vacation clubs with limited transferability.

Inheritance tax advantages: For European residents, France fractional ownership offers inheritance tax efficiency—your heirs pay French inheritance tax (droits de succession) on only 1/8th of the property value (your fractional share), yet they retain full usage rights to the complete property for their allocated weeks. Compare this to sole ownership where heirs face inheritance tax on the entire property value (potentially hundreds of thousands of euros), making fractional ownership significantly more tax-efficient for multi-generational family vacation homes.

Estate planning considerations: France fractional shares should be included in estate planning documents (wills, trusts, succession arrangements) specifying beneficiaries and transfer terms. French succession law applies forced heirship rules (réserve héréditaire) protecting certain heirs’ rights, but proper estate planning ensures your France vacation property passes according to your wishes. International owners should consult cross-border estate planning professionals familiar with French property law and their home country tax treatment.

Family continuity: Multi-generational France fractional ownership allows grandchildren to ski the same Méribel slopes, vacation at the same Cannes beach, or explore the same Paris neighborhoods their parents and grandparents enjoyed, creating family traditions and shared memories spanning decades. The professional management ensures the property remains well-maintained across generations without heirs managing renovations and repairs.

Is France fractional ownership suitable for families?

France fractional ownership is exceptionally family-friendly, offering multi-generational appeal, diverse activities across regions, predictable annual vacations, and property sizes accommodating extended families without hotel logistics. France’s family-centric culture, excellent infrastructure, and activity diversity make French vacation properties ideal for children, teenagers, and grandparents across all ages.

Family activity diversity across France regions:

French Alps fractional properties offer ski schools for children (as young as 3-4 years), teen ski programs, childcare services, family-friendly pistes, sledding, snowshoeing, summer mountain biking, hiking, via ferrata, and alpine adventure parks. French ski resorts maintain high safety standards and comprehensive family services compared to many international destinations.

South of France fractional properties provide sandy beaches, beach clubs with children’s programs, water sports (kayaking, paddleboarding), coastal walks, Provençal village exploration, farmers’ markets, ice cream shops, and mild weather suitable for outdoor activities across extended seasons. 300+ days of sunshine ensure reliable beach weather compared to northern European coasts.

Paris fractional properties offer world-class museums (many with children’s programs), Luxembourg Gardens (playgrounds, puppet shows, model sailboats), Seine river cruises, Eiffel Tower, Disneyland Paris (30 minutes), patisseries, crêperies, and cultural immersion exposing children to history, art, and French language.

Multi-generational appeal: France fractional properties accommodate grandparents (cultural interests, wine tourism, slower-paced activities), parents (skiing, beaches, city exploration), and children/teenagers (ski schools, water sports, theme parks) in single trips, with larger properties (3-5 bedrooms) providing private space for extended families. Professional management eliminates vacation planning stress for parents, who simply arrive to fully prepared properties.

Predictable family traditions: France fractional ownership creates annual family traditions—Christmas ski weeks in Méribel, summer beach vacations in Cannes, spring Paris culture trips—building shared memories and family identity around European vacations. Children grow up returning to the same chalet, same beach, same neighborhood, creating deep connections to places unlike annual hotel changes.

Educational value: France vacation homes provide cultural education—children learn French language basics, European history, art appreciation (Paris museums), geography (Alps, Mediterranean, wine regions), and international perspectives—enhancing global citizenship and cultural fluency.

How liquid is France fractional ownership if I want to sell?

France fractional ownership offers good resale liquidity compared to sole ownership of luxury vacation properties, particularly in prime destinations with sustained international buyer demand. Fractional shares trade more easily than full properties due to lower price points attracting larger buyer pools, while France’s status as the world’s most-visited country ensures ongoing cross-border interest in French vacation homes.

Liquidity factors supporting France fractional resales:

International buyer demand: Foreign buyers represent 2% of all French property transactions nationally, rising to 13% in Alpes-Maritimes (Côte d’Azur) and 12% in Haute-Savoie (French Alps). Americans average €715,000 purchases, British dominate Alpine markets, Dutch account for 10% of foreign buyers, and Belgians, Scandinavians, Middle Eastern, and Asian buyers remain active, creating deep international buyer pools for France fractional shares.

Price point accessibility: Selling a €500,000 fractional share attracts thousands of potential buyers globally who can afford this investment level, versus selling a €4 million sole-ownership property requiring ultra-high-net-worth buyers—a far smaller market. This price point advantage accelerates fractional resales compared to full property sales.

Strong appreciation in prime markets: France fractional shares in high-performing locations (Saint-Tropez +15% annually, Antibes +20.8%, Cannes +12%, Paris luxury +69% transactions) attract investment-oriented buyers seeking appreciation potential alongside lifestyle benefits, supporting demand for resales. Buyers recognize France fractional ownership delivers deeded equity and market appreciation unlike timeshares with minimal resale value.

Management company support: Many France fractional management companies offer resale assistance, maintaining buyer lists of prospective purchasers interested in their properties, marketing support, and transaction facilitation. This professional infrastructure improves liquidity compared to private party sales requiring individual marketing efforts.

Market timing considerations: Resale timelines vary by market conditions, property desirability, and pricing—prime France fractional shares (Cannes beachfront, Méribel ski-in/ski-out, Paris Left Bank) may sell within 3-12 months of listing, while less premium properties could take longer. Realistic pricing reflecting current market values and comparable sales accelerates transactions.

Comparison to timeshares: France fractional ownership offers exponentially better liquidity than timeshares, which rarely sell for meaningful value and often require owners to pay companies to offload them. Fractional shares are genuine real estate with market value and appreciation potential, creating legitimate resale markets.

Bottom line: While France fractional ownership isn’t as liquid as publicly traded stocks, it offers reasonable resale liquidity for real estate assets, particularly in prime destinations with strong fundamentals (sustained tourism, limited supply, international demand, appreciation history). Buyers should view fractional shares as medium-term investments (5-10+ year horizons) rather than short-term trading vehicles, allowing time for market appreciation and optimal selling conditions.

Start Your France Fractional Ownership Journey

France fractional ownership combines world-class skiing, Mediterranean beaches, cultural capitals, and proven investment performance in Europe’s most diverse vacation destination. Whether you’re drawn to French Alps’ legendary ski resorts, Côte d’Azur’s glamorous coastline, Paris’s cultural prestige, or a complete portfolio spanning all three, your European vacation home is within reach through co-ownership.

Explore France fractional ownership by region:

French Alps Fractional Ownership Properties – Ski chalets and four-season mountain lifestyle

South of France Fractional Ownership Properties – Mediterranean villas and Côte d’Azur living

Paris Fractional Ownership Properties – City apartments and cultural immersion

Build your complete European vacation portfolio across alpine skiing, coastal beaches, and city culture with France fractional ownership.

Discover Premium France Fractional Ownership Properties

Are you looking for that perfect French home in a stunning setting? Look no further than France, where you can find an incredible selection of properties available through fractional ownership (also called co-ownership) right now. We have fractional ownership properties across France’s most desirable regions including Paris, the French Alps, and the South of France. Contact us for the latest entries.

But what if you don’t have the budget to buy that amazing Parisian apartment in Saint-Germain or that splendid ski chalet in Courchevel outright? Fractional co-ownership could be your answer. Let’s explore why buying a French property through fractional co-ownership makes so much sense today, especially when you think that just one share gives you 1.5 months/year to enjoy.

From elegant Haussmann apartments with breathtaking city views to Alpine ski chalets and Mediterranean villas, finding your dream French home couldn’t be easier! Whether you’re seeking a cultural retreat, ski vacation, or Mediterranean escape, France offers diverse options to suit every lifestyle. Discover all that France has to offer and secure your piece of French paradise today. We have over 20 years of experience selling French properties.

Investing in a fractional ownership (co-ownership) property in France provides an exceptional opportunity for those seeking a luxurious and cost-effective way to enjoy the country’s diverse landscapes, rich history, and world-class cuisine at a fraction of the traditional cost.

Ready to own that dream French property?

Get in touch with our team to secure your share today.