The Forgotten History of Fractional Ownership: How Families Have Been Sharing Properties for Centuries

Modern platforms may promise revolutionary property sharing, but the concept has been quietly flourishing in family estates across Europe and America for generations.

Whilst technology evangelists (us?!) herald fractional ownership as a groundbreaking innovation in property investment, the reality is rather more prosaic. For decades—indeed, centuries—families have been practising this form of shared ownership, often through necessity rather than choice, as cherished holiday homes passed down through generations are divided amongst increasingly numerous heirs.

The statistics paint a compelling picture of this inadvertent fractional ownership model. In the United States, second homes typically remain within families for a median of 16 years before sale or transfer, longer than the 13-year average for primary residences. Yet this figure masks a more complex reality: many holiday properties, particularly those in desirable legacy locations, can remain within family ownership for multiple decades through inheritance structures.

The European Model: Generational Persistence

The European experience proves even more instructive. Across Finland, France, Spain and Italy, it remains commonplace for families to retain second homes—rural cottages, coastal retreats, or historic properties—across several generations. Finnish summer cottages, for instance, frequently remain in the hands of descendants of the original owners, sometimes for periods exceeding a century.

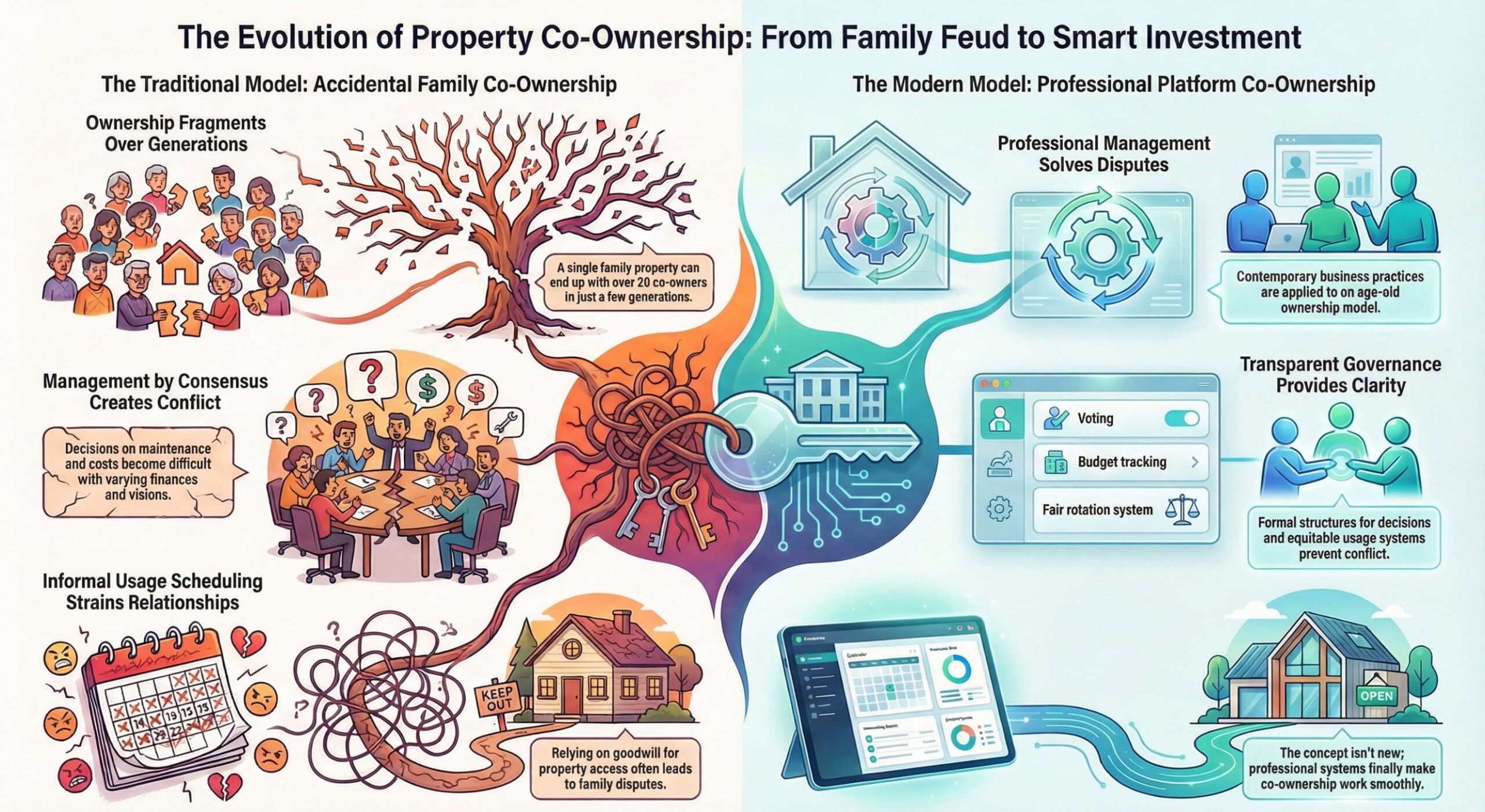

However, this longevity comes at a price. European inheritance laws, which typically mandate equal division amongst all children, inevitably create what amounts to forced fractional ownership. Properties that began as single-family retreats gradually accumulate multiple owners as they pass through generations. It is not unusual to encounter holiday homes owned by three to ten relatives, each holding fractional stakes determined by inheritance rather than investment appetite.

Yet today’s economic realities are placing unprecedented strain on this traditional model. With inflation eroding purchasing power, property taxes escalating across European jurisdictions, and salaries failing to keep pace with living costs, many families find maintaining generational properties increasingly untenable. The romantic notion of preserving a great-grandmother’s Tuscan villa becomes a financial burden when repair costs demand contributions from relatives struggling with their own mortgage payments and rising energy bills.

Case Studies in Compulsory Co-ownership

Consider the archetypal French mas in Provence, purchased by a prosperous merchant in 1920. By 1950, it had passed to his three children. By 1980, ownership had fragmented amongst nine grandchildren. Today, some twenty-three great-grandchildren hold stakes ranging from 1/23rd to 3/23rds, creating a Byzantine ownership structure that would challenge any modern property management platform.

Similar patterns emerge across the Atlantic. The Sullivan County study in New York (check source here), which identified that 16-year median ownership period, revealed that properties intended as “generational assets” often accumulated multiple owners through inheritance succession. These arrangements can sustain family ownership for decades, but management becomes increasingly complex as the beneficiary pool expands and family affairs can be, let’s say, “complex”.

The Hidden Costs of Family Fractional Ownership

This traditional model of fractional ownership, whilst preserving family heritage, carries considerable drawbacks that modern platforms seek to address. Maintenance decisions require consensus amongst relatives who may harbour different visions for the property. Capital improvements demand contributions from family members with varying financial circumstances. Usage scheduling relies upon goodwill and informal arrangements that can strain relationships across generations.

The phenomenon is particularly acute in regions with strong inheritance traditions. Italian coastal properties and Spanish holiday villas routinely accumulate ownership structures resembling small publicly traded companies, complete with family disputes that would make corporate governance specialists blanch.

The Modernisation Imperative

Today’s fractional ownership platforms like co-ownership-property.com recognise these historical challenges whilst seeking to capture the benefits of shared property investment. By creating transparent governance structures, professional management protocols, and equitable usage systems, they address the practical difficulties that have long plagued family-owned fractional properties.

The evolution from “Aunty Felicity’s say in the Juliet balcony repairs” to professional property management represents less a revolution than a logical progression. Modern fractional ownership simply applies contemporary business practices to an ownership model that families have employed—often reluctantly—for generations.

The irony is palpable: whilst investors flock to platforms promising innovative property sharing, millions of families across Europe and America have been practising fractional ownership for decades, discovering through experience both its advantages and considerable complications. The true innovation lies not in the concept itself, but in the professional infrastructure now available to make such arrangements actually work.

As second-home ownership costs continue rising and younger generations seek more flexible property access, the lessons embedded in centuries of family fractional ownership become increasingly relevant. The model works—it simply requires proper management to avoid the pitfalls that have challenged families for generations.

Ready to own that dream property?

Get in touch with our team to secure your share today.